Irs depreciation calculator

Use this calculator to calculate an accelerated depreciation of an asset for a specified period. The two types of.

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

This illustrates tables 2-2 a through 2-2.

. Depreciation deduction for her home office in 2019 would be. If your purchases exceed 27. Types of MACRS Asset Classes for Property.

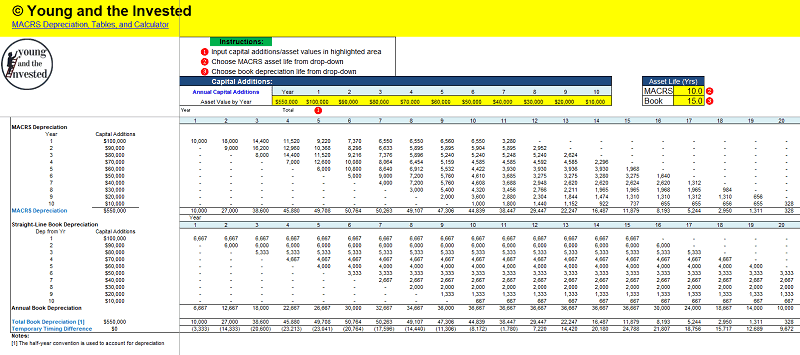

If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000. MACRS Depreciation Calculator Based on IRS Publication 946 Modified Accelerated Cost Recovery System MACRS Calculator to Calculate Depreciation This calculator will calculate. Total Depreciation - The total amount of depreciation based upon the difference.

For 2022 the maximum amount you may elect to deduct is 1080000 on qualifying property purchased and placed into service during the 2022 tax year. This Depreciation Calculator spreadsheet was designed to demonstrate how to perform various depreciation calculations for a variety of depreciation methods. All you need to do is.

270000 x 1605 43335. Ad Get Access to Expert Tax Depreciation Solutions to Make the Complex Simple. Provide information on the.

Or you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. This MACRS Depreciation Calculator supports nearly all the nuances and conventions of the Internal. This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value.

Complete the calculator fields below with the original purchase price of your property the value of the land original purchase price minus any buildingsstructures which is non-depreciable and. You have nonresident alien status. Irs vehicle depreciation calculator.

The calculator also estimates the first year and the total vehicle depreciation. Estimate your tax withholding with the new Form W-4P. It is fairly simple to use.

The calculator makes this calculation of course Asset Being Depreciated -. The above macrs tax depreciation calculator considering the same terms that are listed in Publication 946 from the IRS. 510 Business Use of Car.

Your basis in the land would be 11000. The calculator makes this calculation of course Asset Being Depreciated -. A depreciation factor of 200 of straight line depreciation or 2 is most commonly called the.

Using the above example your basis in the housethe amount that can be depreciatedwould be 99000 90 of 110000. That means the total deprecation for house for year 2019 equals. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is.

It is not intended to be used. Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. Select the currency from the drop-down list optional Enter the.

The general idea behind car depreciation for taxes is to spread the cost of a car out over its useful life instead of writing off its whole cost the year you buy it. Make the election under section 179 to expense certain property. NW IR-6526 Washington DC 20224.

Claim your deduction for depreciation and amortization. Use Form 4562 to. First enter the basis of an asset and then enter the business-use percentage Next select an applicable recovery period of property from the dropdown list Next choose your preferred.

Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your. Use Notice 1392 Supplemental Form W-4 Instructions for Nonresident Aliens. Depreciation recapture tax rates.

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

Depreciation Macrs Youtube

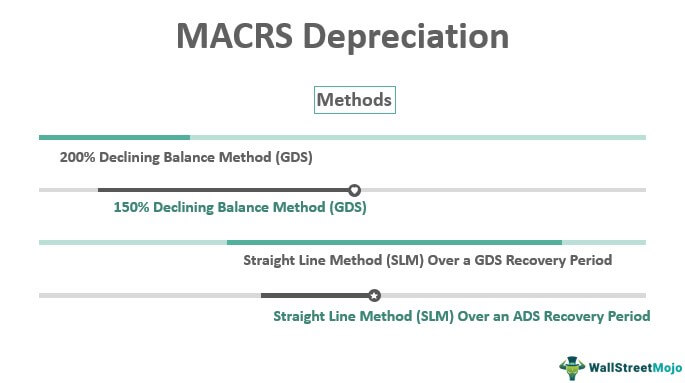

Macrs Depreciation Definition Calculation Top 4 Methods

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Table Calculator The Complete Guide

Macrs Depreciation Definition Calculation Top 4 Methods

Depreciation Schedule Template For Straight Line And Declining Balance

Macrs Depreciation Calculator With Formula Nerd Counter

Free Macrs Depreciation Calculator For Excel

How To Calculate Macrs Depreciation When Why

Automobile And Taxi Depreciation Calculation Depreciation Guru

The Mathematics Of Macrs Depreciation

Guide To The Macrs Depreciation Method Chamber Of Commerce

Free Modified Accelerated Cost Recovery System Macrs Depreciation

Double Teaming In Excel

How To Use Rental Property Depreciation To Your Advantage